Why do Prescription Discount Cards Work?

Do Prescription Discount Cards really work?

Prescription discount cards claim to offer significant savings on medications, sometimes up to 80% or even 97%. Outside of clearance aisles and Black Friday sales, no other retail setting offers discounts that steep. The question arises, are these deals real or are they too good to be true? Let’s find out.

Discounts off of Cash Pricing

The quick answer is yes; these cards are a legitimate way to save on prescription costs at the pharmacy. However, if you have insurance, you may not experience such substantial discounts. The advertised savings apply to the cash price of the medication, meaning you're not using insurance or any other discounts. Typically, when we pay in cash at a store, we expect the lowest price because there are no additional transaction costs. In other words, we expect paying cash will bring us the most price relief. In the healthcare and pharmacy world, it's the opposite. Paying cash often means paying more than anyone else.

The Bizzaro World of Pharmacy Pricing

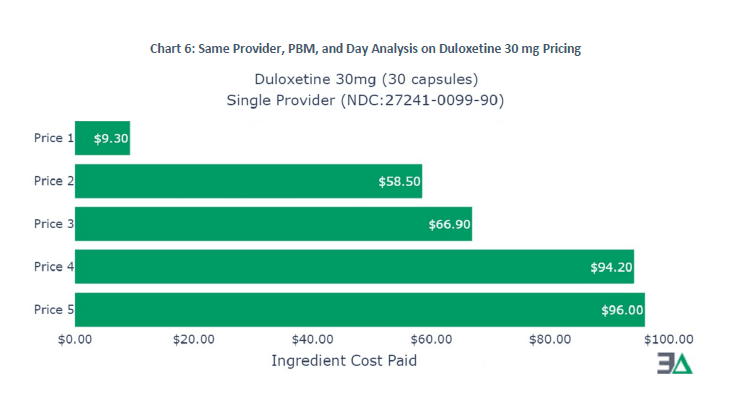

To understand why cash paying patients pay more, let us look at an example. 3Axisadvisors studied one day's worth of data for a single medication, Duloxetine, from a single insurance carrier, at one pharmacy location.

As you can see, all variables are the same, EXCEPT the price patients paid with their insurance. The insurance carrier had multiple plans and each plan had a different negotiated price with the pharmacy. In the graph we can see that one of the insurance carriers’s plans was willing to pay the pharmacy $96.00 for Dulxetine. Another of the insurance carrier’s plans negotiated the low rate of $9.30 for the exact same medication. Given the wide range of prices, the pharmacy must set its cash price above $96.00 even though it would take less. Unfortunately, people without insurance end up paying this higher price when they pay cash. If the pharmacy lowers their price to the lowest price, $9.31, to help the uninsured, they would be forced to lower the price they charge all the insurance plans. Is the pharmacy then just greedy? In reality, ultra low prices on one medication often result in the pharmacy losing money on the medication. However their negotiation strategy ensures that the difference is made up on other medications. Similarly, the insurance plans likely traded higher prices on Duloxetine in exchange for lower prices in a different category more important to their strategy. This dynamic keeps list prices artificially high.

Enter Prescription Discount Cards

Prescription Discount cards work in a similar way. They negotiate rates and discounts with pharmacies, trading higher prices in some categories for lower prices in others. The advertised discounts of up to 80% are based on the same high list prices that insurance companies negotiate down from. While prescription discount cards will secure dramatic discounts on some medications, most medications will not be as significant.

Highest Prescription Discount Today

Since prescription discount cards offer varying savings rates and can change rates daily, it can be challenging to know if you're getting the best price today. You have a couple of options: 1. Compare multiple top prescription discount cards every time you need to fill a prescription. 2. Use a Pharmacy Savings website like RxCard Compare, which searches all major prescription discount cards and manufacturer coupon cards for you. This not only saves you time but also helps you make an informed decision about whether to use your insurance or a prescription discount card for your prescription today. In conclusion, prescription discount cards can be a real way to save on your medications, but the actual savings may vary by card. It is essential to stay informed to get the best deal for you today.